Make financial controlling & compliance a tactical lever

Financial controlling & compliance is not solely about adhering to laws and regulations. It is also about creating value for the company's many decision-makers by ensuring precise, transparent and efficient financial reporting. Valid and reliable reporting supports management's strategic, tactical and operational decisions, while ensuring credible communication both internally and externally.

However, this task becomes increasingly difficult with the growing complexity of regulations and business activities, which challenges the task with practical change.

Fortunately, we can help. Both if you need extra hands to handle a specific task, and if we need to help elevate the quality or efficiency of your controlling to a higher level.

Get guidance to achieve practical solutions

Get guidance to achieve practical solutions

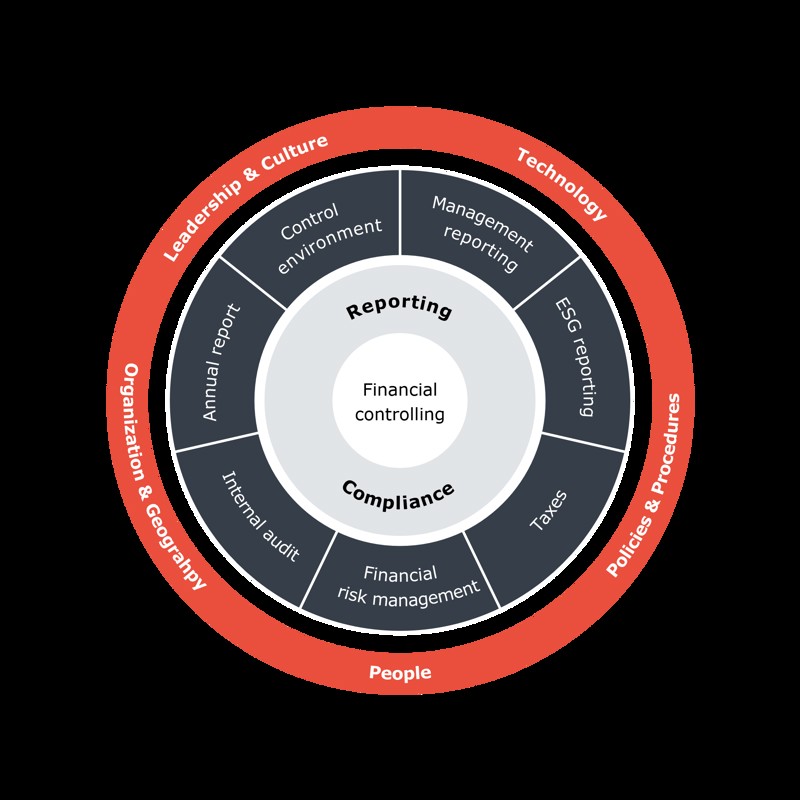

Here you can see our Financial Controlling & Compliance Framework. The figure highlights the seven main areas in a typical Finance organisation, which we can therefore provide advice on. These are the seven areas you can read about on this page.

Annual report: Create efficiency in your year-end closing

The year-end closing is the culmination of the annual cycle. Beyond the satisfaction of 'closing the chapter’ on the completed year, the annual report represents the conclusion of a wide range of tasks that have been worked on throughout the year. But an annual report is not just an annual report – and the path to get there can look vastly different. Our specialty is helping you find the approach that creates the most value for you.

We help with, among other things:

- Optimisation of the year-end closing process through effective planning, automation and digitalisation, saving you time and minimising the risk of errors

- Advice on accounting practices and implementation of new legal requirements, ensuring your annual report complies with all applicable rules and standards

- Establishment of a robust control environment and documentation, ensuring quality in reporting and facilitating cooperation with auditors.

Control environment: A control environment that is both compliant and efficient

In a time of increasing legislative complexity, a control system that effectively addresses compliance-related risks is crucial. However, it is a complex task – both due to increased regulatory complexity, changes in the company's activities, or because of macroeconomic conditions that cause your company's risk landscape to change.

We help with, among other things:

- Mapping and assessment of your current activities and processes with focus on identifying and evaluating risks and optimising control activities

- Continuous monitoring and updating of risks and control activities, ensuring you are always up-to-date with new regulatory requirements and business changes

- Implementation of effective technology support for control activities, ensuring compliance with applicable legislation, resource-efficient management of roles and responsibilities etc.

Would you like to read about how we helped Penneo transition from Google Sheets to a robust and system-supported control environment? Read the article here.

Management reporting: Create value with internal reporting

Many companies apply the same principles for preparing internal monthly reports as those used for the external annual report. As a result, they overlook a potential benefit of differentiated principles, since the purpose of management reporting is to support business decisions at various management levels and across different organisational areas.

When internal reporting is not based on principles that drive the right decisions, because accounting rules applicable to the annual report may have other purposes, it can negatively influence the usefulness for ongoing financial management.

We can help you strengthen internal reporting – without compromising external reporting. We do this by, among other things:

- defining relevant KPI’s and structures in close collaboration with management and ”the business”

- supplementing with operational and leading indicators, e.g. order intake, production costs and customer satisfaction

- analysing accounting data that converts your transactions into valuable business insights

- evaluating and adjusting calculation methods – e.g. for IPO, R&D and leasing – so they also make sense for internal management

- simplifying and clarifying the presentation of data through, for example, classification, visualisation and key figures over time.

Read here how you can achieve more value-creating internal reporting.

ESG reporting: Get structure and control in ESG reporting

The increased requirements and expectations for sustainability reporting mean that ESG reporting is no longer something that can be handled ad hoc or at the last minute. It is a reporting that requires solid processes, controls and governance.

We have consultants who are specialised in supporting Finance with ESG reporting, and we can help you with, among other things:

- developing and implementing a robust and effective ESG operating model and accounting manual

- defining and documenting data points, accounting policies and estimation principles

- designing governance structures and control environments for ESG data and ensuring audit readiness

- acquiring and implementing ESG systems

- strengthening collaboration with auditors and ensuring audit readiness

- preparing periodic and annual internal and external ESG reports.

ESG reporting is such a complex and broad area that at Basico, we have dedicated a special task force to it. You can read all about our approach to both the operational and advisory aspects of ESG on this page.

Read here how a solid accounting manual creates value for your ESG reporting. (Not online) !!!!!!!!!!!!!!!!!!!!

Taxes: Get a handle on corporate tax, VAT and duties

Handling corporate tax, VAT, duties and customs is becoming increasingly complicated. The rules are extensive and changeable, partly because they are used as political instruments, and they can be difficult to interpret, partly because new rulings periodically emerge that change previous assessments.

At Basico, we have consultants who specialise in the tax area, and we can help you with, among other things:

- designing and implementing business procedures and internal controls targeted at tax compliance

- completing tax returns and various forms

- updating transfer pricing documentation.

In this article, you can read about how strong processes can minimise errors in indirect taxes. (ikke online)!!!!!!!!!!!!!!!!!!!!!!

Financial Risk Management: Structured risk management

In a time of increased global uncertainty, geopolitical tensions and rapid market changes – factors that all affect financial risks – effective risk management is a necessary discipline in any Finance organisation, which of course must be adapted to the company's risk profile.

Companies face complex challenges in credit, liquidity and market risks – depending on, for example, the company's customer composition, financial situation and global presence and value chain – where the responsibility is placed in Finance.

A proactive approach to risk management is no longer just an advantage, but a prerequisite for profitability, robustness and ultimately also survival ability etc. And perhaps you can even transform potential threats into strategic opportunities by strengthening the company's competitiveness.

We help with, among other things:

- identifying and quantifying financial risks through thorough analyses and scenario planning, giving you a clear overview of your exposure

- developing tailored risk management strategies with concrete action plans that balance risk minimisation with business opportunities

- implementing effective monitoring systems and KPIs that provide timely insight into risk development and support proactive decisions

- building a robust risk management culture in the organisation through competence development and optimised processes that anchor risk thinking in daily operations.

Internal Audit: Independent assessment that strengthens risk management and control environment

Internal audit is described as the company's third line of defense. Its purpose – independent of day-to-day management – is to serve as the board's extended arm to oversee the company's risk management in relation to e.g. risk assessment processes, whether controls are effectively executed etc.

Additionally, internal audit can function as a specialist-level sparring partner to strengthen the company's 1st and 2nd lines of defense. Companies not subject to legal requirements for internal audit can draw inspiration from this sparring partner role without implementing the formal arrangements – which are not truly value-creating – that independence from day-to-day management entails.

We help with, among other things:

- evaluating risk management and control procedures

- testing critical control activities and addressing significant risks

- assessing the reliability of the data foundation for reporting

- monitoring regulatory requirements and ensuring compliance.

Make your business stronger with strong insights

Get professional inspiration with substance directly in your inbox.

Subscribe to our newsletter, Insights by Basico. Then you will also receive our specialist magazine Content.

Would you like to know more?

en

en

da

da